Blog

Houthi's 20% Racial Taxation (2020)

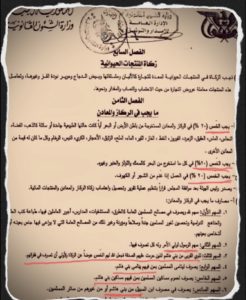

Republic of Yemen

Ministry of Legal Affairs

Chapter Seven

Zakat on Animal Products

Article (46):

Zakat is required on animal products intended for trade, such as dairy products, chicken eggs, silkworm silk, etc. These products are treated as commodities for trade in terms of calculation, quorum, quantity, and the like.

Chapter Eight

What is required in ore and minerals?

Article 47:

The fifth (20%) (tax) must be collected from the ore and minerals extracted from the ground or the sea, whether their natural state is rigid or liquid, such as gold, silver, copper, diamonds, agate, emerald, turquoise, oil, gas, water, salt, mercury, stones, gravel, sand, marble, and whatever minerals that have value.

A fifth (20%) (tax) must be collected for everything that has been extracted from the sea such as fish, pearls, amber, and others.

A fifth (20%) (tax) must be collected from honey if collected from trees or caves.

Following the approval of the Council, the Chairman of the Commission shall issue a decision regulating the process of identifying, collecting and calculating Zakat for Ore, Minerals and Aquatic Products.

Article 48

(A) Areas of spending (beneficiaries) from ore and minerals tax:

The first share is for God and is spent in the public interest of Muslims, such as roads, hospitals, schools, workers’ wages, the printing of science books and school curricula, and fortifying Muslims’ borders/fronts with soldiers, weapons, supplies, and other public interests in which are not specified for certain people or groups.

The second share is from the Prophet to the Ruler, and he has the right of disposition for that share.

The third share is for the kinship of the Bani Hashim, for whom charity was forbidden, so God made the fifth for them instead of Zakat and should be spent on their poor.

The fourth share is spent for Muslim orphans, including Bani Hashim orphans.

The fifth share is spent on all poor Muslims, including those of Bani Hashim.

The sixth share is spent for the travelers from Bani Hashem, or other Muslims.

B – following approval by the Council, the Chairman of the Commission issues the decision regarding details and restrictions of the Ore and Minerals’ zakat areas of spending.